A safe withdrawal rate is a rate which you can comfortably draw down from your investment portfolio, with the least likelihood of your portfolio being run out until you are gone. If you do your own research on safe withdrawal rate, you are bound to receive plenty of answers, and very good justification as well.

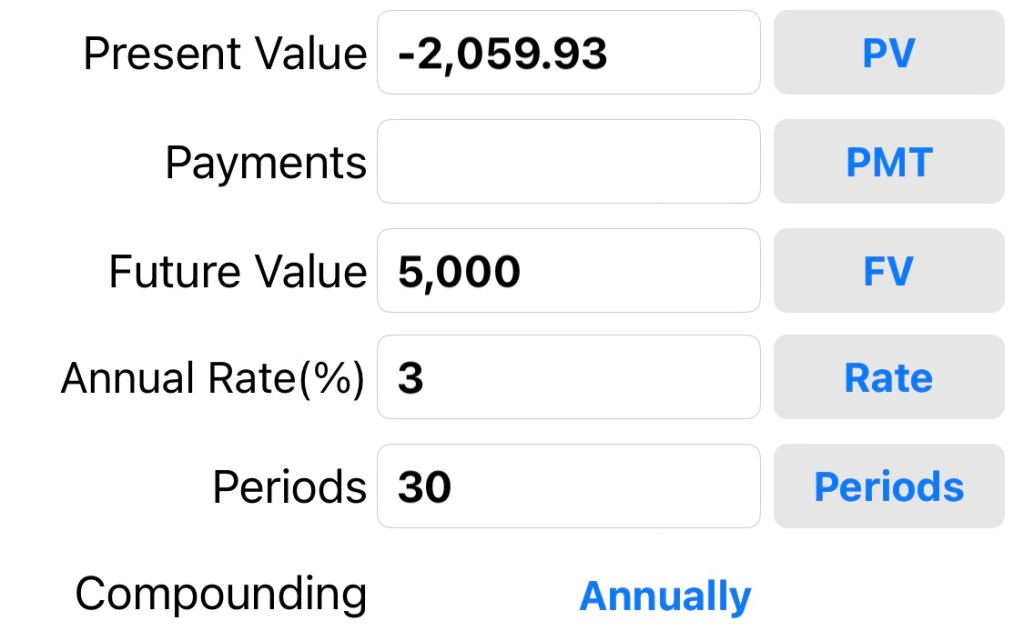

Since there are already many credible sources recommending their safe withdrawal rate, I’m not going to back my rate with much justification then. Never complicate things, just take the average will do. My personal view is 3% withdrawal rate is a conservative rate one should work on. Under the most pessimistic scenario if you park all your investments into treasury bills and safe asset class, this rate can last you for at least 35 years, inflation adjusted. Come on, if you can reach financial freedom and decide to retire and start draw down on your investment at say age 40, you are going to have a good life until 75 without worrying about running out of money at all. Chances is, after you are 75, your lifestyle expenses will drop and you can probably depend on your CPF life ( Singapore’s version of Pension Scheme, Central Provident Fund) to fund your remaining life. By then you will also have a fully paid house, worst come to worse you can rent out 1-2 rooms for rental income.

My take for the 3% rule is simple; it doesn’t mean that when the 3% is able to fund your lifestyle, you are going to throw the letter to your boss. Retirement, or financial freedom, is actually a state of mind. That being said, there’s a number you would want to achieve. Once you achieve it, your mind is free, and you are able to roam around, and see what’s the next move you want to make, without a worry on the finances. People have regrets in life, and many was due to the financial constraints they had during the large chunk of their life, which sort of prevented them from doing the things they wanted do. I can totally understand that, in particular if you need to support the elderly at home, and the young kids if you have a family.

If 3% is a safe withdrawal rate, what I feel is of most importance is, what’s in your investment portfolio. You would want to exclude 2 key assets from the portfolio:

1. Your home: your residential property is not an asset because it doesn’t generate you income. Even if your property appreciates from $500k to $1m, it only make you feel good and feel rich. That’s all. If you have a second home for investment purposes, it’s then an asset. If you decide to stay and retire permanently in an emerging country with lower expenses, and rent out your property at your birth country, then it’s an asset. In short, it has to produce an income.

2. Your CPF: for Singaporean, the monies in your CPF can only be unlocked from age 55. The CPF is a wonderful pension scheme, backed by a strong government. The main objective of CPF and introduction of CPF Life is to ensure that every elderly has a lifelong income when they retire at age 65. This will eliminate the issues of elderly not having an income at older age and hence depends on social security etc. That being said, if you desire to retire earlier than 55, you might want to exclude this CPF balance totally from your withdrawal rate. It’s better to play it safe and accumulate more anyway.

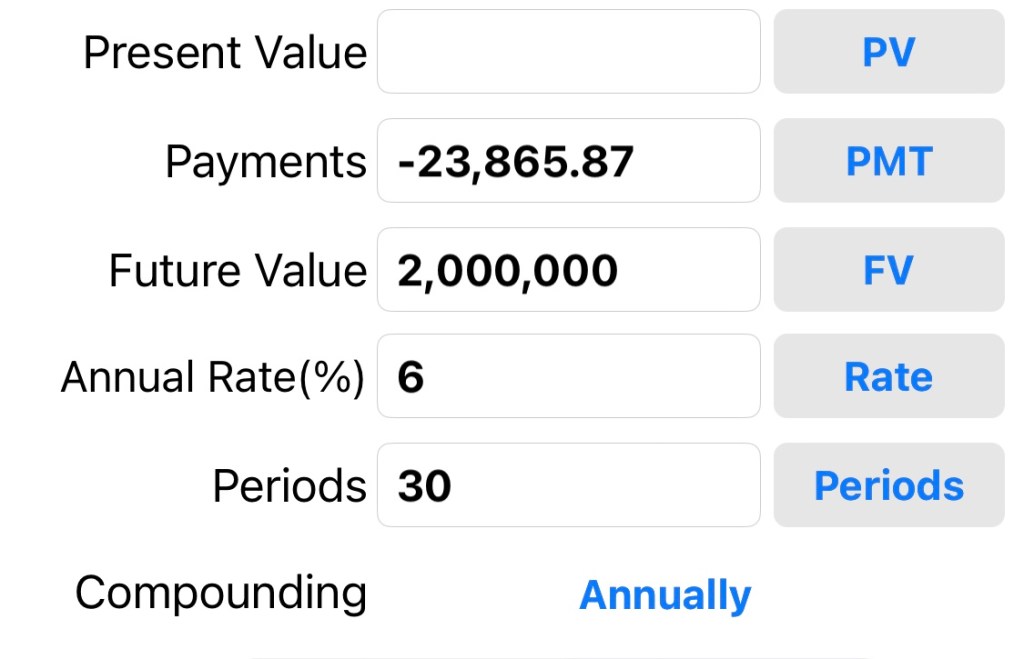

Once we exclude these 2 assets, then it gives you a very clear direction on what you need to do next. If your desire of a lifestyle today cost you $2000 a month, and setting a timeline of 30 years to achieve your financial freedom, you probably need to save and invest $2000 per month right now. Do take note that your desired lifestyle will increase in cost over time as shown above in the diagram. Someone who just started out perhaps only can set aside $1000 a month for investment due to other commitments, but you will also progress in your career, so as you progress, you want to increase the allocation so that eventually you reach the magic number of your own. In my illustration, it’s $2,000,000.

When you are working out your financial plan, you want to be conservative in your numbers. If things work out well, congratulations, you are able to achieve your goals earlier. Otherwise your planned timeline is in 30 years time. Obviously, you want to do it earlier, and my advice to many people is, to do it earlier, it’s not to invest in riskier assets, in particular, things you don’t understand, and worst still, listen to your friends whom they think they are an expert. Rather, focus on investing in yourself. When you invest in yourself, you may progress faster in your career, and hence your paycheck will massively increase.

The best investment

Warren Buffett

you can make,

is an investment in yourself. The more you learn,

the more you’ll earn.

In summary, I think 3% is a decent rate to stick to, and you are never going to run out those money, at least until you die. However, if some were to think that 4% is better, then it’s fine. These are simply guidelines, and it should be flexible in nature and work well in your situation. Most importantly, you want to be truthful to yourself, and exclude some of the “assets” which are not suppose to be in your investment portfolio.

PS: If 4% safe withdrawal rate is being used, and $2000 is the cost your desired lifestyle today, then you only need to build a $1,500,000 investment portfolio in 30 years.