Well, let’s see.

You have $1m cash in a Private bank, and the rest are investible assets. Otherwise you can’t open a private bank account ya 😉.

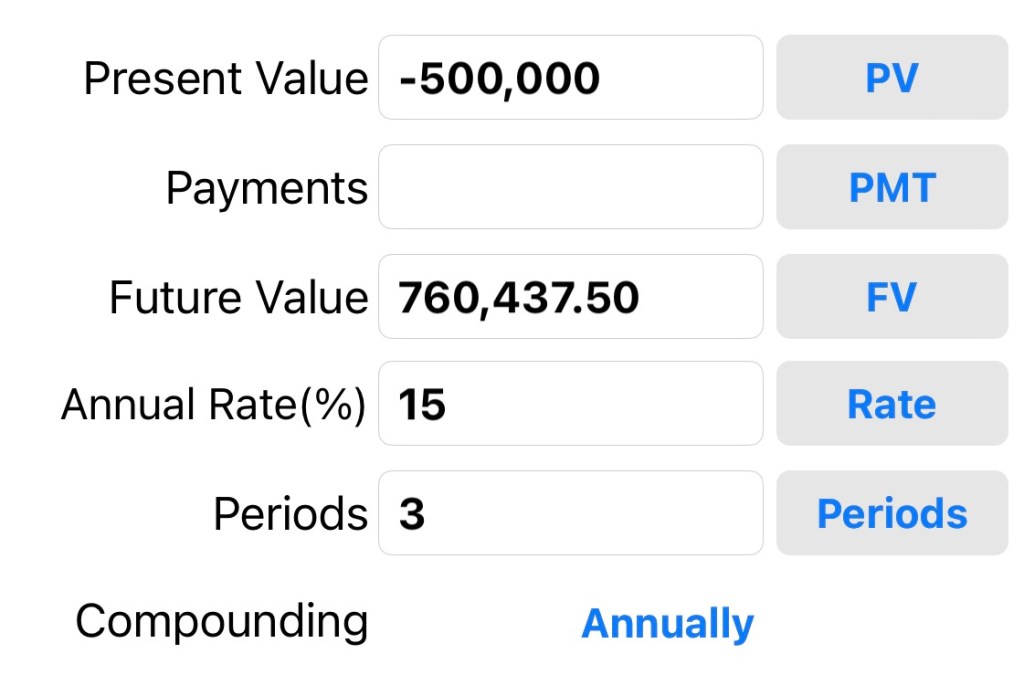

Bank give you OD facilities and you decide to use the facilities instead of your cash to invest in a real estate investment $500k, giving you 15% p.a. So happy I can leverage, woohoo 🥳.

OD interest 4% a year: $20k a year.

3 years: $60k paid.

Your real estate investment over 3 years, profit: $260k

Your $1m in bank, interest earned in 3 years: $1500

Total Profit earned: -$60k+$260k+$1500: $202K

Sounds good so far? 😎

Now, let’s see if IBC work better here…you have $1m in your policy value.

You take a $500k policy loan, loan interest 6% p.a. You decide to let it accrued and only pay it back 3 years later. Insurer allows you to do that. Own time Own target 🎯.

Interest incurred: $96k

Profit from your real estate investment: $260k

BUT

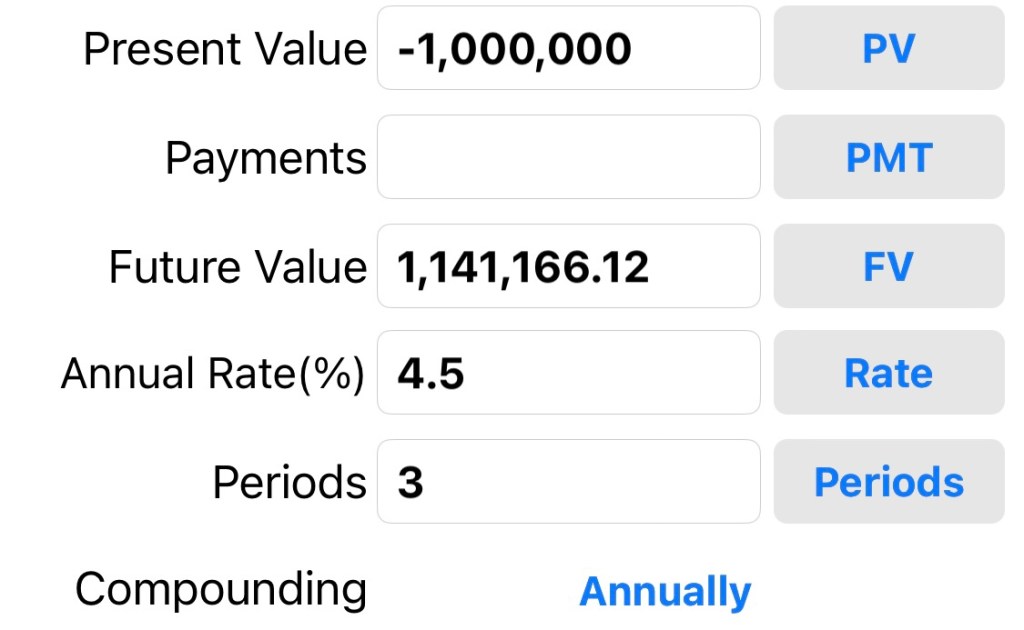

you have your policy value $1m generating interest over next 3 years

Profit from Insurance policy: $141k

Total profit: -$96k + $260k + 141k = $305K

$305K totally trumped $202K profit if you used your bank OD method.

Conclusion

Why is this so? Is there anything wrong with my mathematics?

No…

The problem lies with the money/ cash you put. Money in traditional bank is not put to work at all, but money in insurance policy aka your OWN BANK work 80x harder and hence give you the profit you deserve!

Hence it’s definitely not about which “OD” facilitates gives better loan interest, but it’s about where you should park your cash now.

However, if you are able to take an OD which offers better loan interest, and yet park your cash in insurance policies, that’s the ideal as the cost of borrowing is lowered. That being said, why would bank give you that OD if you don’t park your assets with them! Besides, if anything drastic were to change regarding your investment portfolio, example you had Credit Suisse junk bonds, I guarantee you that they will claw back your OD facilities!