If you want to achieve financial freedom, you need a goal and a deadline. In this section, I’m going to share with you how to simply use the financial calculator to construct a strategy for yourself.

First, you need a goal, and a timeline to achieve this goal. Let’s say I’m age 25, and I would desire to retire at 50, with a passive income of $5,000 per month. To make it simple and clean, I have no savings at this moment, and just started out working.

The above I think is what many average Joe would dream about, but many would not about to think further beyond dreaming. Why? For a start, they are not even earning $5,000 income, so why should I even think about financial freedom of $5,000 monthly at 50?

Dream is free. Don’t waste it. Do it often until it becomes a reality.

Sam

Before you squash your own dreams with the reality which you are in, let’s play with the financial calculator and work towards it! I use Ez Calculators and you may download it from your App Store.

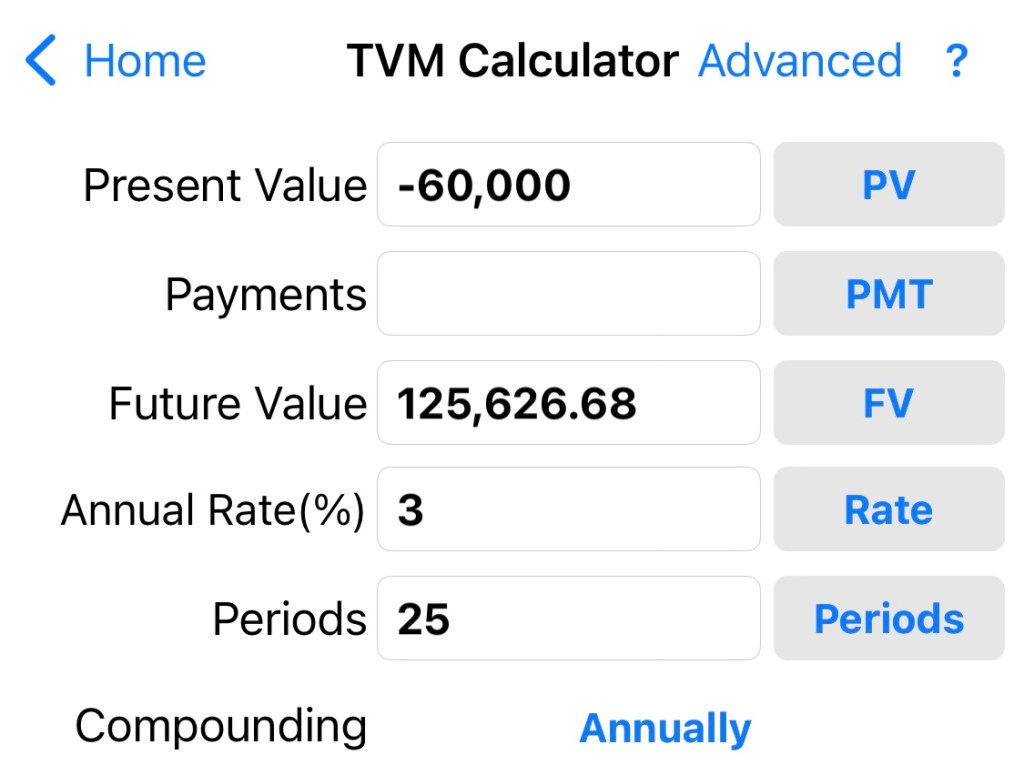

Looking at the above scenario. The first thing we need to tackle is the goal; $5,000. Now, because of inflation, the $5,000 lifestyle you desire today will increase over time. Hence we need to factor in a long term inflation rate say 3%.

By the time you reach 50, the lifestyle you desire is going to cost you $10,500 a month, and it will only increase over time.

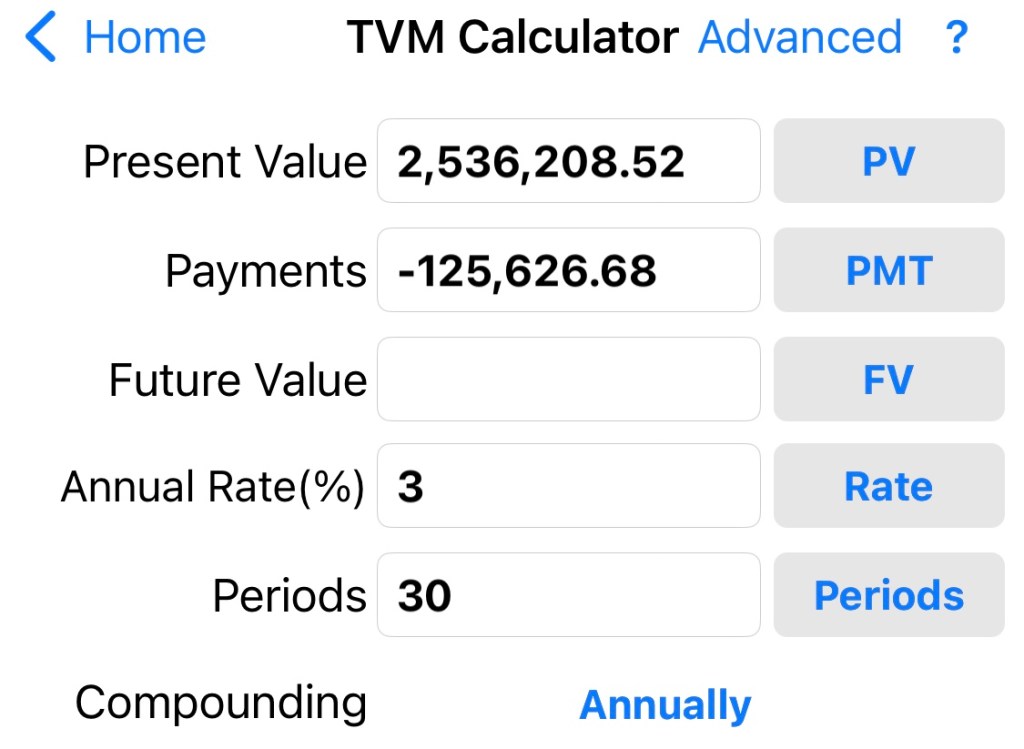

Next, let’s assume you are going to live till 80 and you are going to live this kind of lifestyle for the next 30 years from 50 to 80. (Chances is, your lifestyle will drop as you age, but let’s plan more for it.)

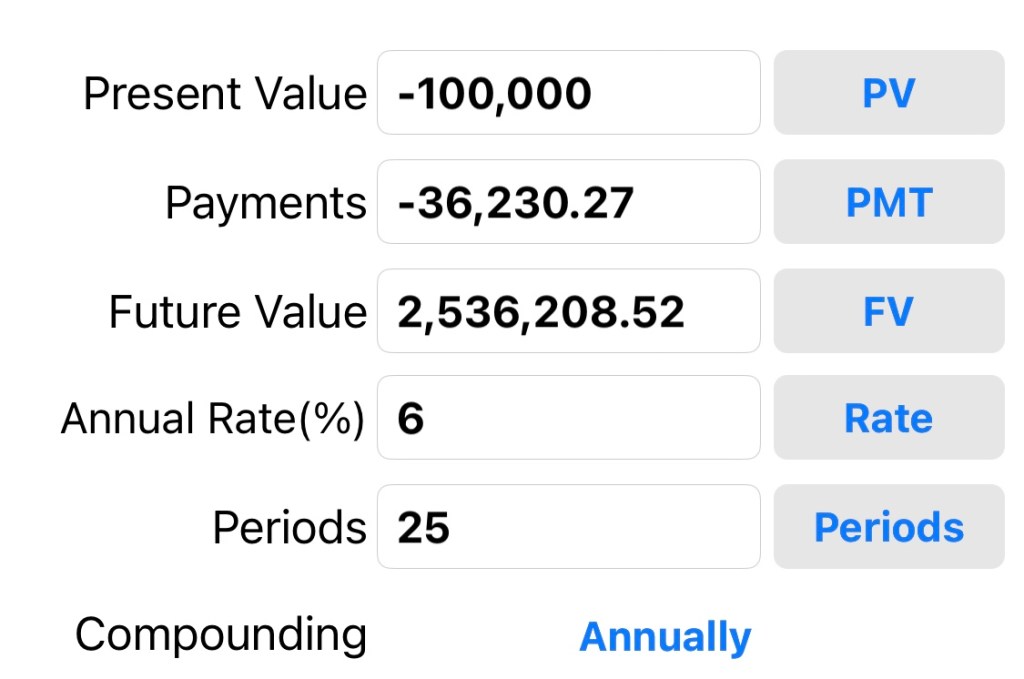

We assume the inflation rate at 3%, and your investment return at 6%, and hence simplified inflation adjusted return of 3%.

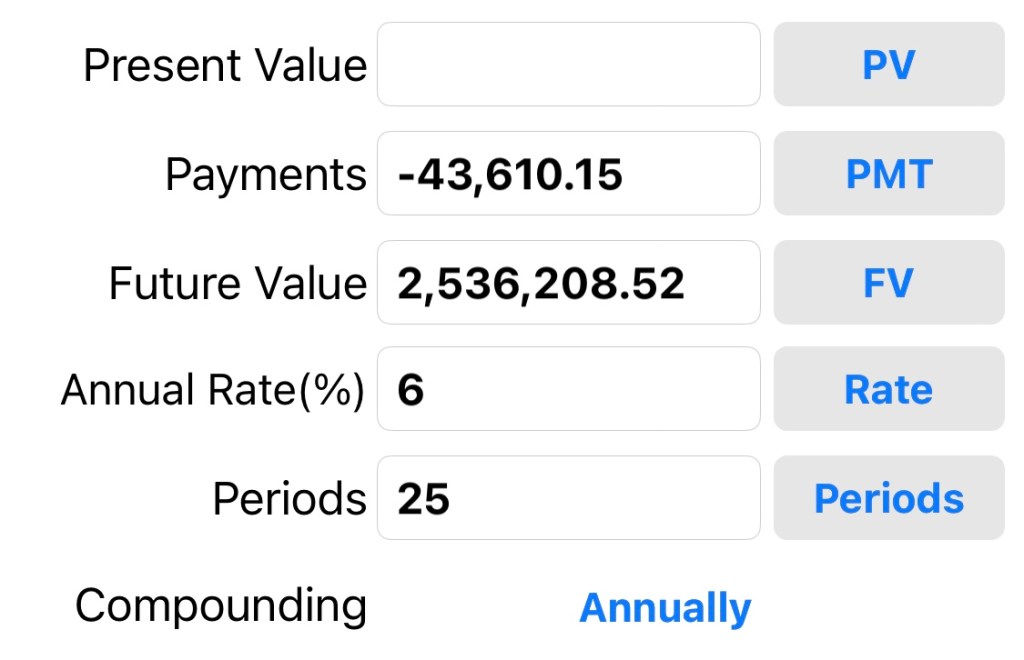

Now you have that magic number now, $2.5m. Let’s work it backwards to today. How much do you need to save and invest so that you can build $2.5m?

What’s your thoughts after you see those numbers? Impossible? I think it’s doable? I think I need to change job. Or let’s dream lesser? Or let’s forget about it? Or let’s start with something first, and build from there?

You are the master of your life, and you punch the numbers yourself. You decide what options you want. With the financial calculator, at the very least, you know what’s your options, and what you can do about it.

When comes to planning, I take on a conservative approach. That’s why I put the inflation rate at 3% p.a long term (I know now it’s about 5.5%, but long term is less than 3% though), and investment return of 6% p.a. The S&P 500 generated about 10% p.a return over the past 30 years, so my 6% p.a is pretty conservative.

Once you have constructed your plan, and decide where to allocate your funds, let it go on autopilot mode. Any excess, go spend it on yourself and others, enjoy your life because you do not want to be too obsessed with such planning until you become paranoid, worrying, and always scrimp on those dollars.