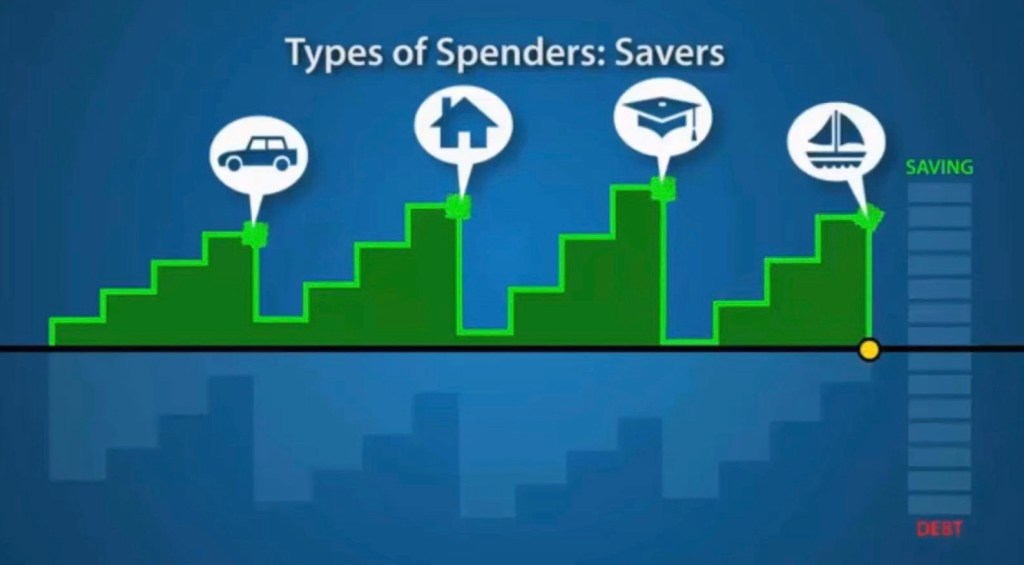

When you can earn more than you spend, you have a surplus and it’s called savings. Therefore you are a savers. However this group of people, which many of us fall into, know what is compound interest, but often commit the mistake of not truly implementing it.

Allow me to qualify my statement above. Why do we save? We save for raining days, for purchases which we want, namely cars, houses, and holiday. The biggest mistake we made is every time we saved enough, we spend away our savings for that big ticket item, and therefore you lost on the effect of compounding interest.

Before I illustrate my point, I know what you are thinking again. What’s the point of me saving then if I can’t spend? Well, I didn’t say you can’t spend. I only said the above spending pattern result in loss of compounding effect. Stay tune in my next article to learn more on how the wealthy spend their money and create wealth along the way.

Allow me to illustrate the loss of compounding effect first.

Let’s assume you have saved $100,000 and decide to purchase your dream car. For simplicity sake, you fully paid it.

As you paid for it, your bank account turned zero, and you start saving again for your next purchase; a house. 3 years later, you saved $100,000 for a house. Again, you spend it, and your account goes back zero.

What have you lost then then?

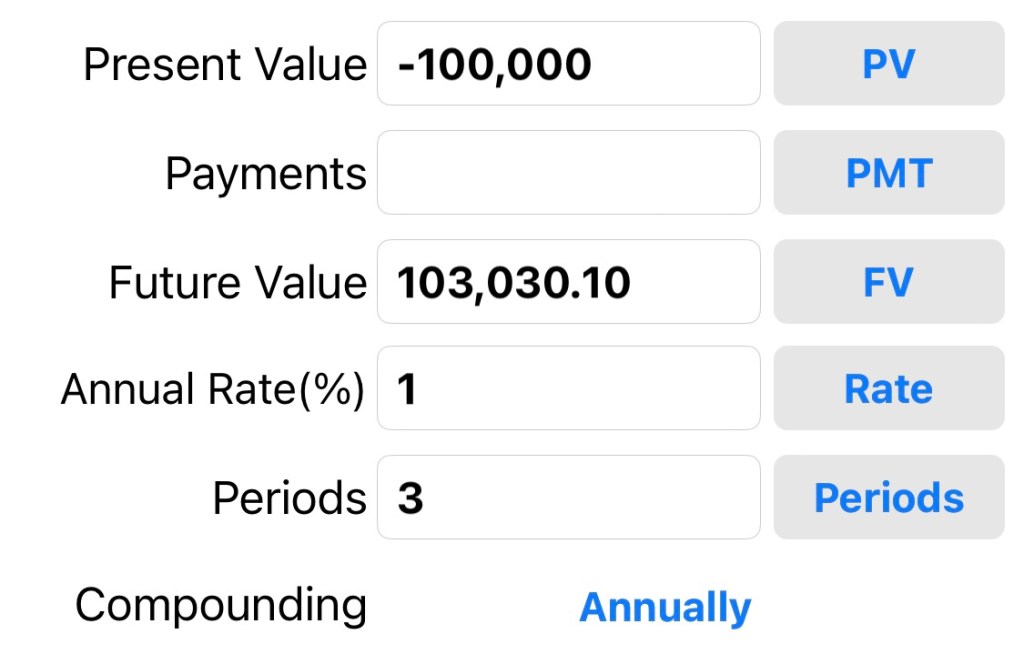

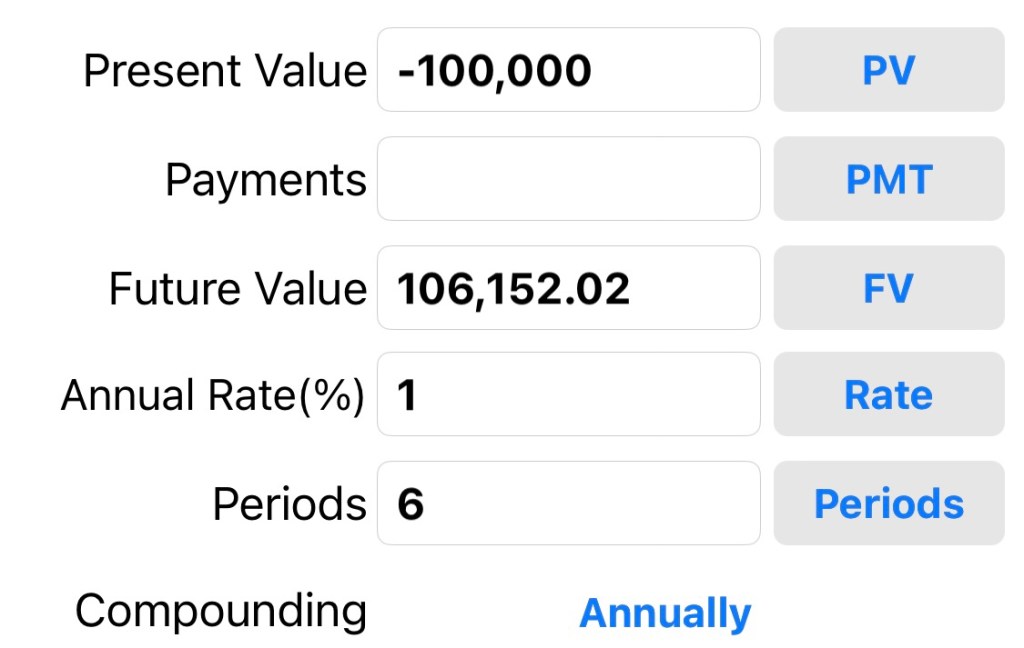

When you spent for 1st $100,000 for the car, you have lost the compounding interest it could have earned for you. If your bank interest gave you 1% p.a., that’s $1000 for year 1, $1010 for year 2, and $1020 for year 3. You have lost $3030.10 on those 3 years.

Now you have accumulated another $100,000 and you shall spend it to fund your house. You would have lost another $3030 for next 3 years on this new $100,000. If you add the previous $100,000, that’s further interest lost.

Over that 6 year of spending your $100,000 and saving $100,000 and spend and building another $100,000 again, you have lost

1st $100,000: $6,152

2nd $100,000: $3030

Total lost: $9,182

If you stretch these over 20-30 years, the lost will be even much more.

Compounding interest means interest earning interest. When we save, and spend it all on our next big purchase, what we essentially had done was trading off our prized milk Cow for that car. We lost the Cow which can milk, and decide to rear a calf before it turns into a milk Cow again. We made the same mistake again, by trading off that milk Cow for the house. We tear a calf again. The pattern continues, and what you have lost is the many milk cows.

Remember that I mentioned that bank is not a good place of storage? Never will they want to give you high interest. Hence many savers committed 2 mistakes; first they park their money in a low interest account, and second they spend those money for things that don’t grow. As a result, the wealth keep on depleting while they fund their purchases.

Some more if you take loan on your purchase, what happen is not only you pay interest to someone (the bank) for your purchases, you also lost the interest which you rightfully should earn. That’s a double whammy.

Hence I hope in this article we acknowledge that our spending pattern has resulted in the lost of momentum for compounding effect to take in. Compounding effect is like a snowball. As the small snowball roll from top of the mountain, it gets bigger and bigger, and the velocity gets higher.

Let’s explore next on how you can create wealth by being a wealth creator!