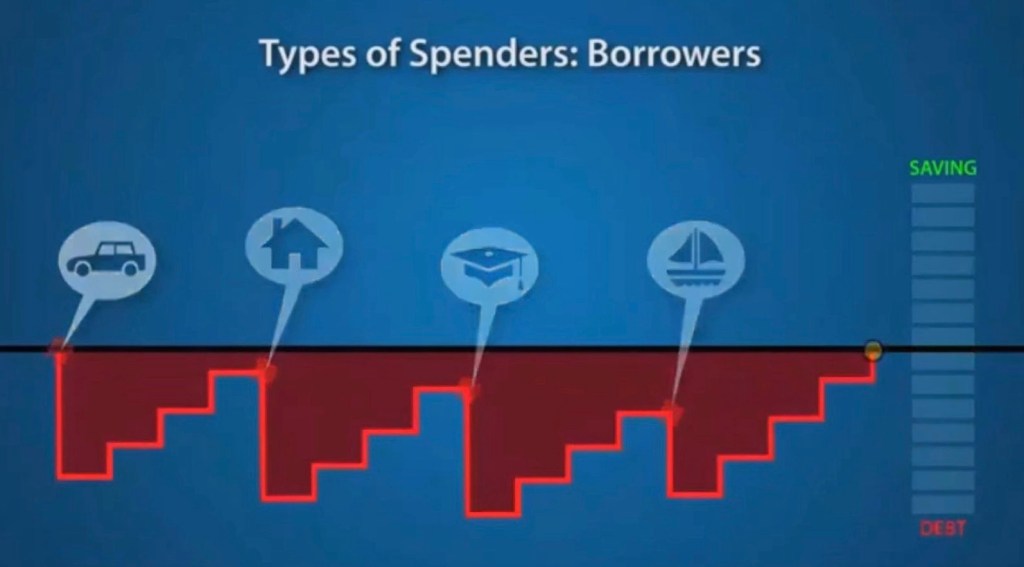

There are 3 types of spenders when it comes to money; debtors, savers, and wealth creators.

When you spend more than you earn, you are a debtor/ borrower

It’s as simple as that. It didn’t help much to many people that the moment when they start working, they are able to apply for credit card. If you have a poor financial blueprint, trouble awaits with that card. Why is that so? Credit card is basically a facility for you to use your future money to fund your purchases. The business itself has evolved from simply buy now, and pay later (30-45 days later when you receive your bill) to more sophisticated services of buy now, and spread your pay over next 5 years. That’s the most dangerous service you can utilize if you don’t have a sound financial mind. Interest payment is a whopping 30% p.a if you decide not to pay your bill in full by due date. Personally, I have witnessed a friend who purchased a luxury watch using his credit card, and spread it over 60 months of installment. He’s using his future money. Imagine he has less than a thousand in his bank account, but he has a credit card. He purchased a watch worth $30,000 and pay $500 per month on a free interest installment plan. If he’s guaranteed an income for next 5 years, I think he will be fine. Things wasn’t that bright for him as Covid strike everyone. Lost his income is one thing, but now he is in debt to the bank who issue him the card. The saving grace for him was the watch he bought was sold off for a slight profit (thanks to those Crypto boomers for the crazy demand of watches), and he was able to pay off those bills. Can you imagine if he were to sign some health or beauty packages using that card? I wonder if there’s value inside there to sold to someone else.

I think credit card is good for points accumulations and miles exchange. I have heard people use it to fund almost all expenses and clocked in millions of miles in exchange of business class air ticket. However If it’s used to help you purchase an expense easily by spreading over many months, I think you are better off without it. Cash is king and you don’t need a credit card to fill up your ego needs.

As I delved deeper into the psychology of these debtors, I realize that it’s all because of their financial blueprint, and it was deeply ingrained in them when they were younger. Well, it’s a long topic on how to change their blueprint, I do have a simple idea for debtors. Set up an automatic deduction account from the bank, and transfer a fix monthly on a monthly basis to another account. Simply, transfer money from A to B on a monthly basis. And lock B up. Easier said than done though, as many people transfer from Bank A to Bank B but they still can access easily to Bank B. What you can do is this;

1. Pass monthly amount to your spouse, partners, or mother to safe-keep it. Many people does that but I actually don’t encourage it. You might divorce your spouse or break up from your partners. Your mum might pass away anytime, and all these money saved might be subject to contentious legal issues. Best is avoid it.

2. Set up joint account with your spouse or loved ones. Set it in such way that if you need to withdraw the money, it requires both party to authorize. In this way, you always have an extra eye to watch on your spending habits. If the joint owner passed on, you still able to draw the money. Hence there’s little legal issues.

3. Set up a forced saving instrument through a simple endowment policy. I realize this is one of the most effective way for you to move from debtor to wealth creator, instead of just debtor to saver. For forced monthly contribution in this instrument is guaranteed to make your money work harder for you do that you can full pay a better watch in future! In fact, such tools already implemented for all Singapore citizen, which is our Central Provident Fund (CPF). Each month we work, about 20% of our income is forced into our CPF, with employer contributing about 17% of it, depending your age. The accounts inside generate a return of 2.5%-5% p.a. Only issue with this is, while it’s safe since it’s backed by government, it’s not liquid as you only can start withdraw it out from age 55 onwards. I have no complains about it, and I think the system is wonderful for many people, especially those with poor financial blueprint.

As you save, you want to make sure your money is in a right place. Bank is good place to transact, but not for storage & growth. Store it somewhere, and I feel that a simple endowment policy or life insurance is a better place to park your money before you deploy it elsewhere.

Hence my advice for debtors, and whoever who have outstanding credit card balance at this moment, set up a forced saving instrument today, live below your means, and very soon you be on a journey to financial freedom. Such strategy won’t reduce your lifestyle. It’s just an adjustment to your lifestyle. It’s about being conscious about your finances compared being oblivious to your cashflow at this moment. Your financial blueprint (sub-conscious mind) probably tell you to just spend money and You Only Live Once (YOLO), and if you let your mind control your actions, you really only can live once a good life. If you can control that mind and implement some simple strategies, you and your family can live a good life forever. Once, or forever, the choice is yours. Choose it wisely

As for credit card, I do acknowledge it’s benefits in terms of points and miles accumulation. I would suggest holding on to just 1 card will do. It doesn’t matter that card give you lesser points as compared to others when you spend on a certain category of products. It’s endless comparison. Use card to your advantage, and start living the life that you deserve!