Many people know what is compound interest, a handful of them understand the power of it, yet only a few took advantage the wonder of compounding effect on money.

There’s nothing new about what I plan to write about this topic. However, what I aim to do is to help you understand what are the mistakes that many people UNKNOWINGLY made with regarding to money and the compounding effect.

There’s only 2 ways of making money – people at work, and money at work. Therefore the earlier you find ways to make money work harder for you, the sooner you are able to reach financial freedom.

If you can save consistently an amount from the income you earned, you are a saver. Otherwise, you always go broke, or you are called a debtor.

If you can make your savings work harder for you on a consistent basis, that’s where you can amass your wealth. Well, of course, if you have a really high paying job, you can amass it faster. However, what I really want to focus on in this article is why it’s very crucial for your money to work hard for you, consistently. We all know they (your money) got to work hard, but we failed to make it consistently. I’ll explain that later, but bear in mind, CONSISTENTLY

Let’s talk about the most basic thing about compound interest. The best example is none other than INFLATION. This is a classic of compound effect, however, working against everyone of us. A dollar of bread today, through a simple inflation rate of 3% p.a., will become $2.09 in 25 years time. The most dangerous thing about inflation is, it never stops, and it will keep compounding year after year. Inflation is permanent.

Knowing this, obviously you have to put your money at work, otherwise in future we got to eat half lesser to survive!

That’s why many of us will put our money to work by putting it into

1. High yield savings account

2. Fixed time deposits

3. Bonds

4. Equities and real estate

5. Other investments

Hence there’s always a search for instruments to beat the inflations. However, I realize the biggest mistake many of us made, including myself, is we never put our money at work ALL THE TIME.

When you make some profit from your investment, what did you do? Many sold it, and went to buy your dream car, your dream house with insta looking renovations and design. Some went to fund a luxury holiday, because you deserve it! I know you deserve it, perhaps you can use other source of money instead.

For me, one of the biggest financial mistake I made was fully paid my Condo by the age of 30. All along it was my dream to be debt free by 30 and owned a car and a condo. While it was a great milestone to achieve and I never regret it, on hindsight it was a poor financial decision made by me.

Your best life decision could be your worst financial nightmare

Sam

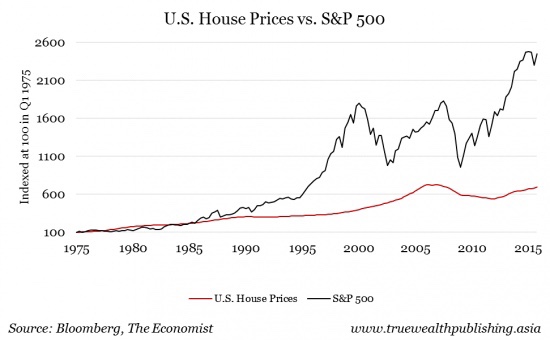

I made huge profit from my stock investment back then, and at that point, I decided to sold it off, and fully paid off my housing debt. I was only 30. Perhaps it was to fulfill my dream, that’s why I said I have no regrets on it and until today I’m proud to say I was debt free by 30. However, as the year passed, I was the equity market continue to advance, while my house value only increase by 2-3% a year. My housing loan interest was only 2% or less back then.

Why did I fail to understand compound interest then? After my money compounded strongly in the stock market, I transferred it to pay off my debt, and my assets now mainly became real estate and it compounded only at 2-3%. The compounding effect greatly reduced because of my financial mistake. I chose to pay off my debt, and missed the great opportunities ahead.

Of course, many of you would have think that who would have thought that the stock market will continue to grow? I could also say that how would I know that real estate will grow as well?

If we look at long term, the equities outperform the property prices. Many of you would have known it. I knew it too long ago. But my ego had the better of me eventually; it’s nice to have that status and have that statement that I’m debt free by age 30. If I had continue to stay invested in equities, and at the same time, leverage on the low interest rate presented to me, I’d have doubled my wealth back then.

While my example was a mistake of transferring from a high return asset class to a lower return asset class, many of us did worse; we transfer our money/ profit from a high return asset class to a loss making asset class, example A luxury car, a depreciating asset for sure. In this case, the compounding effect was totally lost, and that’s a huge setback towards financial freedom. I have a friend who told me about his trading methodology and shared with me how he make money from trading. While I did not doubt his techniques, I wondered by after years of trading, he’s not rich yet? I realised that every month when he claimed to make that few thousands “passive income”, he spent it on necessities. Can you imagine, if his trading technique was proven to be successful, and if he were to compound his profit every month by ploughing back into this trading venture, he’s going to turn millionaire very very soon.

Again, I know some of you might start thinking that we should live our dream. You will live once. Go enjoy. Why stop yourself from buying those cars and paying off the debt. Why am I so hard on myself? I make those money to spend them all. Let’s read on to have a realization next!!!

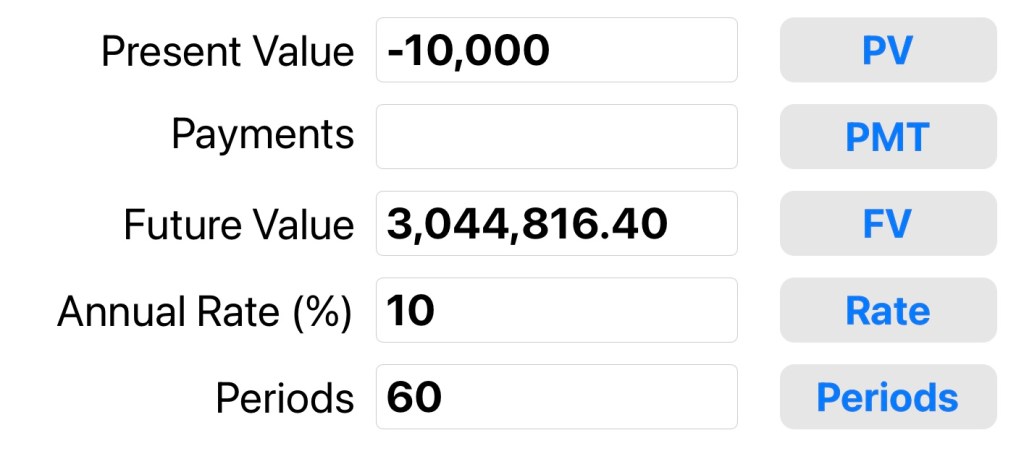

What I actually think and did after my incident was, I set up my investment fund, and decided to “lock it” permanently, until I retire. If I want to buy my car, and fund for holiday, it shall be from a separate pool and from my working income. By doing so, this investment fund will only have money flowing in, and no money flowing out until I retire.

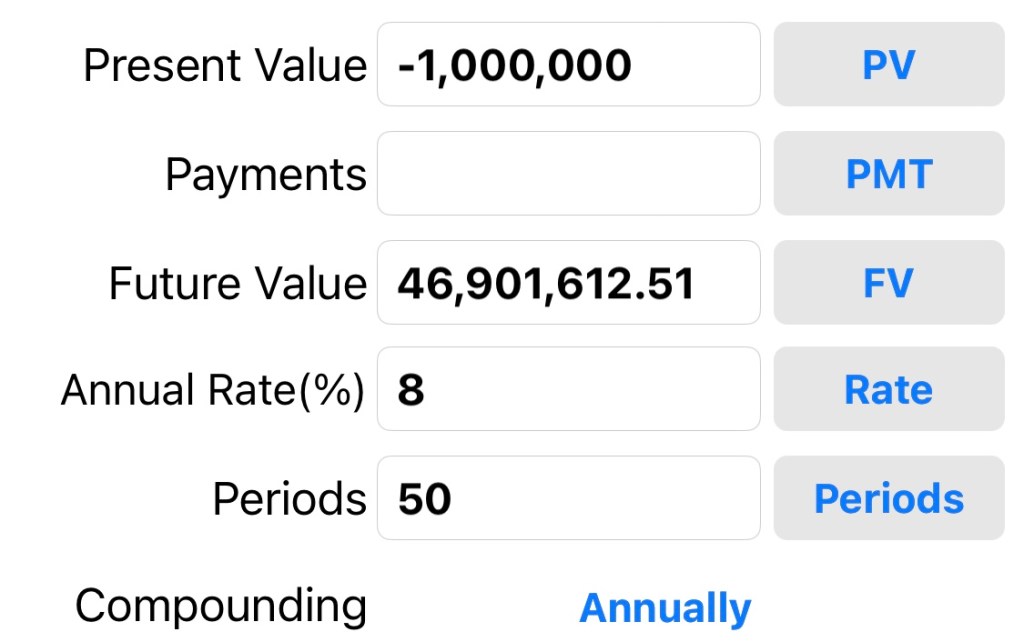

If you look the above, let’s assume you manage to amass $1,000,000 by your mid thirties through your high paying career and high saving ratio, and decent investment. You “lock it up” and leave it there in a S&P500 index fund for as long as you can. It turned into $46,000,000 by the time you turn 85! You see, anyone can be a multimillionaire if you have compound interest work hard for you.

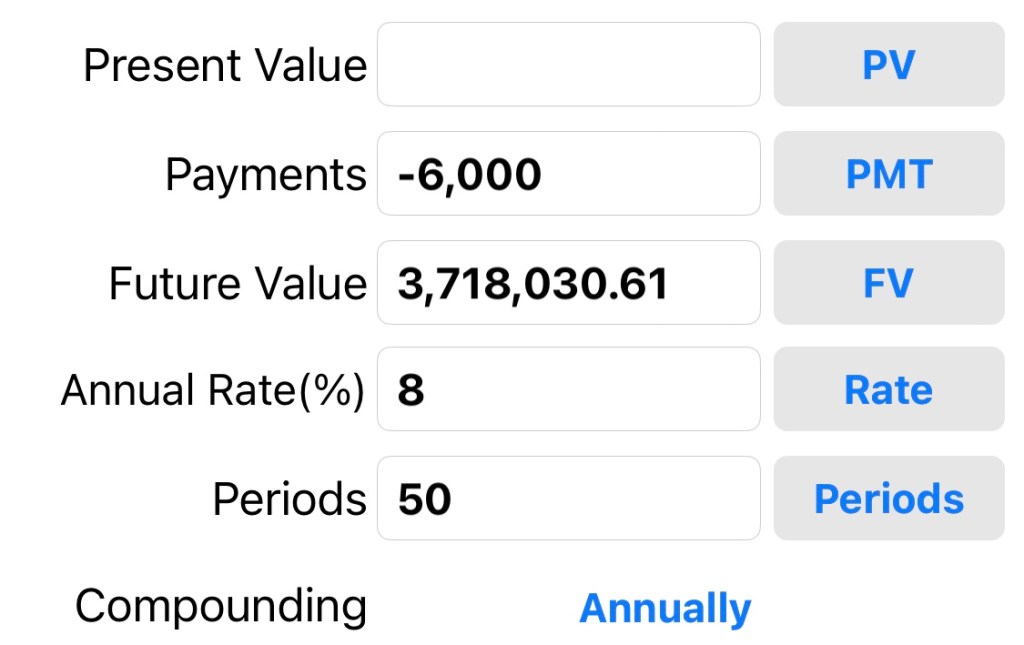

Even if simple $6000 a year investment, put into a boring equity investment, will give you $3,700,000 in 50 years.

I know what you are thinking again. 50 years later? What for I use these money when I’m so old? Wealth accumulation isn’t just for you. Imagine these money can be well utilized for your future generations, and even for philanthropy purposes. Because of the right decision you made today, the fortune of older you and your whole family line has changed. It has to start from someone, and it’s definitely you. Besides, you should fund your other expenses using other funds instead. Refer to my future post on IBC to find out more on how to effectively fund your big item purchases in future.

Hence start locking in your money for investment today, and let it be invested all the time, and stay reinvested all the time and let the law of compound interest make the wonders for you!